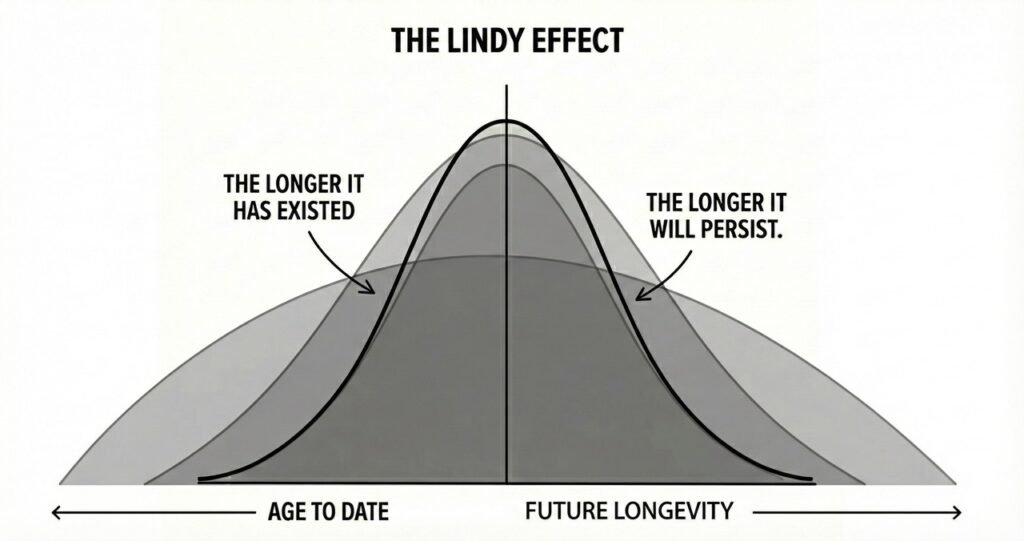

Recently, I’ve started working more deliberately with what is known as the Lindy Effect.

The concept originated in the 1960s among comedians at Lindy’s Deli in New York. They noticed a simple pattern: a Broadway show that had already been running for many years was more likely to continue running for many more years. Not because it was new or fashionable – but simply because it had survived.

Nassim Nicholas Taleb describes the Lindy Effect very precisely in his book, Antifragile:

“If a book has been in print for forty years, I can expect it to be in print for another forty years. If it survives another decade, then it can be expected to be in print for another fifty years. Things that survive over time do not age like people – they age in reverse. Each year without extinction increases their expected remaining lifespan.”

Table of Contents

The Early Years Carry Most of the Risk

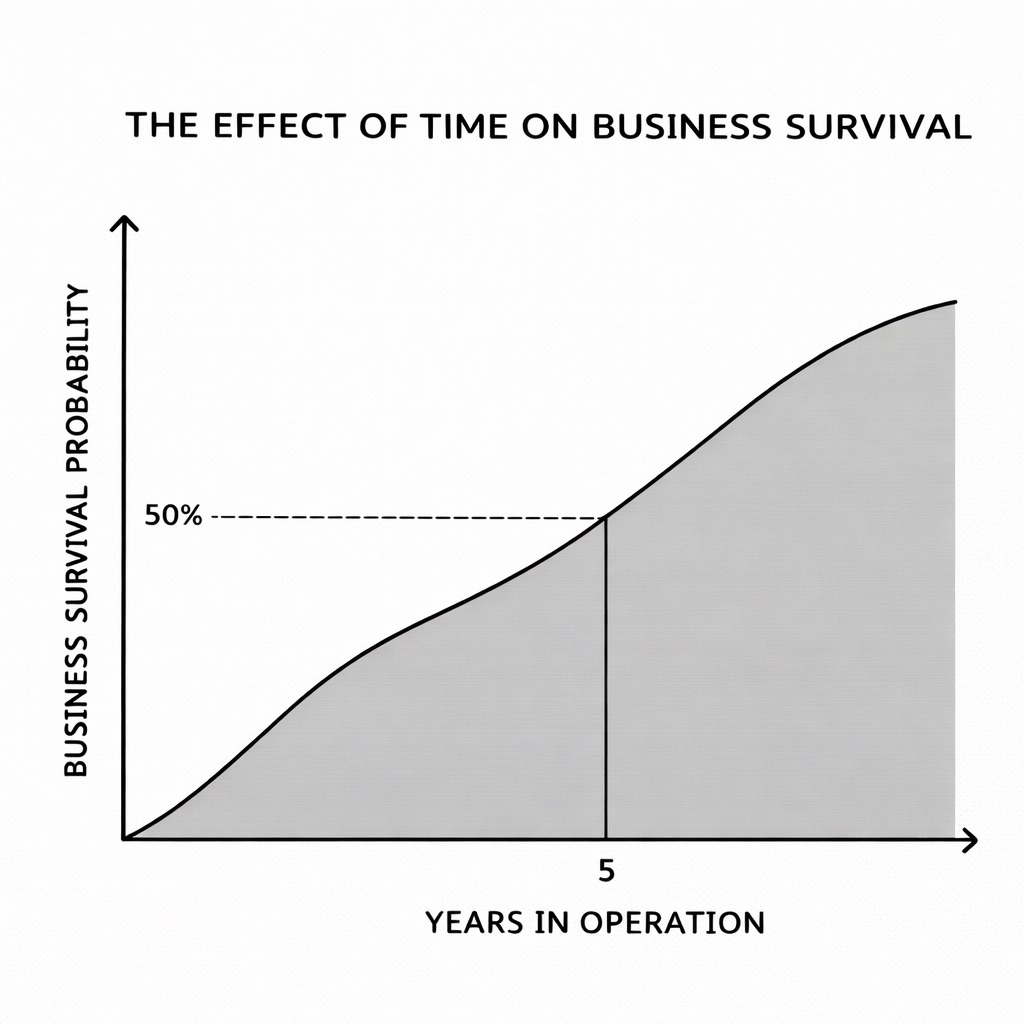

The Lindy Effect is particularly interesting in business because risk is extremely unevenly distributed over time.

The majority of the risk of failure lies in the early years of a company’s life. More than 40% of all business failure risk occurs in the first 3–4 years . After that, the risk drops significantly, with only an additional 15–20% of total failure risk occurring in the many years that follow . The same pattern is reflected in external research from sources such as the U.S. Small Business Administration and the Bureau of Labor Statistics.

A company that has existed for 8, 10, or 15 years is therefore not just “older.” It has survived the most dangerous phase of its life. It has lived through market shifts, customer losses, bad decisions, and likely at least one real crisis.

That makes it structurally more robust.

Companies that have survived for a long time typically have:

- built trust with customers and the market – in modern jargon, product/market fit

- demonstrated real willingness to pay

- found a stable role in the value chain

When AI Changes the Pace

With the rapid rise of AI, I’ve been thinking:

Does AI remove the very foundation of companies that have existed for a long time?

AI has made it extremely easy to build new products, copy functionality, and automate processes. This has led many to conclude that “old” businesses are now under threat.

But precisely because AI reduces friction and increases speed, it becomes clearer than ever which companies actually create real value. Companies that solve a concrete problem for customers in a real market – and that customers are willing to pay for. This is where the Lindy Effect still proves its strength, even as the processes surrounding a company’s core continue to change.

What Does This Mean for Investment and Strategy?

When we at Arnsbo Group look for new areas to invest in, it’s not only about cutting-edge technology.

We continue to invest in startups, new technologies, and new companies. At the same time, we see some of the greatest opportunities in applying new technology – including AI – to older companies that have already proven their value over time.

Often, the most interesting opportunities are companies that:

- have survived the most risk-heavy early years

- have customers, revenue, and documented demand

- but operate with outdated processes and tools

Here, AI cannot replace the business – but it can optimize it. Not by changing what the company is, but how it operates.

Market-Driven vs. Technology-Driven

From my own experience founding and running companies with very different orientations, one pattern is clear: companies that start with the market tend to perform better over time than those that start with technology. Not because technology is unimportant – quite the opposite – but because technology rarely creates value on its own.

Technology-driven companies often start with a what: a new solution, a new platform, a new capability. Market-driven companies start with a why: a concrete problem, a known pain point, and a documented willingness to pay.

This is where the Lindy Effect and AI intersect. AI makes it possible to optimize, automate, and scale faster than ever before. But it does not change the fact that market understanding – not technology – determines whether a company has a core that can survive over time.

That is why Lindy still makes sense as a filter: not to find what is most groundbreaking, but to identify companies where the market has already voted yes – and where technology can make what already works significantly better.